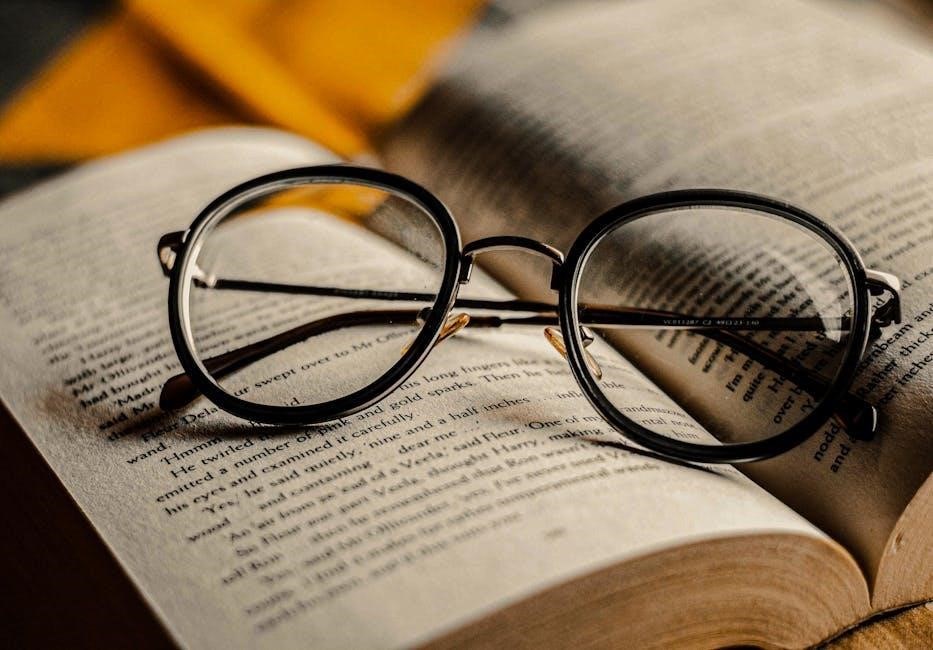

angel numbers and meanings pdf

Angel Numbers and Meanings: A Comprehensive Guide

Angel numbers represent a fascinating intersection of synchronicity, manifestation, and subconscious awareness, often explored in downloadable PDF guides.

These repeating sequences aren’t random; they’re believed to be messages from the universe, reflecting your thoughts and attracting focused attention.

What are Angel Numbers?

Angel numbers are recurring sequences of numbers – like 111, 222, or 333 – that many people interpret as messages from the universe, spirit guides, or angels. These aren’t simply coincidences; they’re considered a form of divine communication, offering guidance and reassurance. Numerous resources, including comprehensive PDF guides, delve into the specific meanings associated with each number and combination.

The core idea is that once you become aware of these numbers, your subconscious mind begins to actively seek them out, a phenomenon linked to synchronicity. This heightened awareness isn’t about the numbers themselves possessing inherent power, but rather the meaning you assign to them. A PDF on angel numbers often emphasizes this personal interpretation, encouraging you to reflect on your thoughts and feelings when you encounter a sequence.

Essentially, angel numbers act as gentle nudges, confirming your path or highlighting areas needing attention. They’re a tool for self-reflection and a reminder that you’re supported on your journey. Exploring a detailed PDF can provide a deeper understanding of these numerical messages and how to apply them to your life.

The Concept of Synchronicity and Number Patterns

Synchronicity, as described by Carl Jung, refers to meaningful coincidences – events that are connected not by cause and effect, but by meaning. Angel numbers are often viewed as prime examples of synchronicity, where the repeated appearance of a number sequence feels significant and purposeful. Many PDF guides dedicated to angel numbers explore this connection, explaining how our brains are wired to recognize patterns.

Once an idea or concept enters our awareness, our subconscious mind becomes more attuned to spotting it in our environment. This explains why, after learning about angel numbers, you might suddenly notice them everywhere – on license plates, clocks, or receipts. A helpful PDF resource will detail how this isn’t necessarily a surge in occurrences, but a shift in your perception.

The universe isn’t actively sending you numbers; rather, you’re becoming more receptive to the patterns that were always present. Understanding this principle, often detailed in PDF materials, empowers you to interpret these sequences as confirmations of your thoughts and intentions, rather than external signs dictating your path.

Manifestation and the Role of Focused Attention

The frequent sighting of angel numbers is often linked to the law of attraction and the power of manifestation. As highlighted in many PDF guides on the subject, focusing your attention on something – even subconsciously – increases its presence in your reality. When you begin noticing these number sequences, you’re essentially amplifying your focus, creating a feedback loop that draws more of them into your experience.

This isn’t about actively trying to manifest angel numbers; it’s a natural byproduct of heightened awareness. A comprehensive PDF will explain this as “effortless manifestation,” where your subconscious mind aligns with your intentions without conscious effort. The more you acknowledge and contemplate these numbers, the stronger the energetic signal you send to the universe.

Therefore, angel numbers can be seen as a visual confirmation that your thoughts are manifesting into reality. Resources in PDF format often encourage journaling about your thoughts and feelings when you encounter these sequences to understand the underlying message and accelerate the manifestation process.

How Your Subconscious Mind Creates Number Sequences

Many PDF resources detailing angel numbers emphasize the crucial role of the subconscious mind. Once an idea, like the significance of repeating numbers, enters your awareness, your brain becomes primed to detect them in your environment. This isn’t necessarily because the numbers suddenly appear more frequently, but because your attention is now directed towards them, filtering them from the background noise.

A detailed PDF guide will explain that this process is similar to noticing a specific car model after you’ve decided you want to buy it – you suddenly see them everywhere. Your subconscious filters information based on your focus, and in this case, it’s actively seeking out number patterns.

This selective attention isn’t random; it’s a powerful mechanism for reinforcing beliefs and manifesting desires. Understanding this process, as outlined in numerous PDFs, empowers you to consciously influence what your subconscious focuses on, ultimately shaping your reality.

Common Angel Number Sequences and Their Interpretations

PDF guides frequently detail common sequences like 111, 222, 333, and 444, each carrying unique vibrational meanings related to new beginnings, faith, and angelic support.

111: New Beginnings and Intuition

Angel number 111, extensively detailed in many PDF resources on angel numbers, is widely considered a potent sign of new beginnings, fresh starts, and opportunities manifesting in your life. It’s a cosmic nudge to pay close attention to your thoughts, as they are rapidly turning into reality. This sequence emphasizes the power of focused intention and effortless manifestation – you’re actively co-creating your reality simply by what you concentrate on.

Furthermore, 111 strongly encourages trusting your intuition and inner wisdom. The universe is communicating with you, and your gut feelings are particularly reliable. PDF guides often suggest journaling when you encounter 111 to capture the thoughts and emotions present at that moment, revealing deeper insights. It’s a reminder that you’re aligned with your true path and supported by the universe, urging you to step forward with confidence and embrace the unfolding possibilities. Don’t dismiss fleeting ideas; they may be divine guidance!

222: Faith, Trust, and Alignment

Angel number 222, thoroughly explained in numerous PDF guides dedicated to angel number interpretations, signifies a powerful message of faith, trust, and alignment with your life purpose. Seeing this sequence is a reassurance that everything is unfolding exactly as it should, even if you can’t see the bigger picture yet. It’s a call to maintain a positive outlook and believe in the process, knowing that the universe is working in your favor.

Many PDF resources emphasize that 222 encourages patience and surrender. Release any doubts or anxieties, and trust that your needs are being met. This number often appears when you’re at a crossroads, urging you to have faith in your chosen path. It’s a gentle reminder to stay balanced and harmonious, fostering healthy relationships and maintaining inner peace. Pay attention to your thoughts and feelings when you see 222, as they offer clues about your current alignment.

333: Support from Ascended Masters

Angel number 333, detailed extensively in PDF guides on angelic communication, indicates that you are surrounded by and receiving support from Ascended Masters – enlightened beings who offer guidance and assistance. This sequence is a powerful affirmation that you are not alone on your journey and that divine help is readily available. Many PDF resources highlight that these masters are assisting with your life purpose and encouraging you to step into your full potential.

Seeing 333 is a call to align with your spiritual path and trust your intuition. It suggests that your creative endeavors are supported and that you should continue to pursue your passions. This number often appears when you’re facing challenges, reminding you that you have the strength and wisdom to overcome them with divine assistance. Pay attention to your thoughts and feelings when encountering 333, as they may contain messages from your spiritual guides, as explained in various PDF interpretations.

444: Angelic Presence and Encouragement

Angel number 444, frequently detailed in PDF resources dedicated to angel numbers, signifies a strong presence of angels surrounding you, offering unwavering love, support, and encouragement. This sequence is a powerful reassurance that you are on the right path and that the universe is actively working in your favor. Many PDF guides emphasize that 444 is a sign of divine protection and stability, indicating that your foundations are solid.

When you repeatedly encounter 444, it’s a message to remain optimistic and trust in the unfolding of your life. It suggests that your hard work and dedication are being recognized by the angelic realm, and you should continue to persevere. PDF interpretations often highlight that this number encourages you to build strong foundations for your future and to embrace opportunities for growth. Pay attention to your inner wisdom and allow the angels to guide you, as detailed in numerous PDF analyses.

Deeper Dive into Specific Angel Number Combinations

PDF guides reveal that combining angel numbers amplifies their meanings, offering nuanced insights into your life path and spiritual journey, fostering deeper understanding.

555: Significant Changes on the Horizon

Angel number 555, as detailed in many PDF guides on angel numbers, is a powerful signifier of impending transformation and substantial life changes. It’s not necessarily about dramatic upheaval, but rather a gentle nudge from the universe indicating that shifts are underway. These changes are often aligned with your soul’s purpose and are designed to propel you forward on your path.

When you repeatedly encounter 555, pay close attention to your thoughts and feelings at that precise moment. What were you contemplating? What emotions were present? These clues offer valuable insight into the nature of the changes approaching. The number encourages you to embrace the unknown with courage and optimism, trusting that these shifts are ultimately for your highest good.

Furthermore, 555 suggests a release of old patterns and beliefs that no longer serve you, creating space for new opportunities and experiences. It’s a call to let go of resistance and surrender to the flow of life. Many interpretations within PDF resources emphasize the importance of maintaining a positive mindset during this period of transition.

666: Rebalancing and Focusing on Spirituality

Contrary to popular belief fueled by cultural misconceptions, angel number 666, as explained in numerous PDF guides, isn’t a negative omen. Instead, it’s a potent message urging you to re-evaluate your life balance and refocus on your spiritual well-being. It signals that your thoughts are misaligned with your soul’s purpose, causing an imbalance between the material and spiritual realms.

Seeing 666 repeatedly suggests you may be overly focused on material concerns – work, finances, possessions – to the detriment of your inner self. It’s a gentle wake-up call to prioritize self-care, meditation, and connection with your higher power. PDF resources often highlight the need to address anxieties and fears that are driving this imbalance.

This number encourages you to simplify your life, release unnecessary burdens, and cultivate gratitude. It’s a reminder that true fulfillment comes from within, not from external validation. Embrace introspection and seek guidance to realign your energy and restore harmony.

777: Luck, Good Fortune, and Spiritual Awakening

The appearance of angel number 777, extensively detailed in PDF guides on the subject, is a profoundly positive sign – a clear indication that you are on the right path and aligned with the universe. It signifies a period of immense luck, good fortune, and spiritual growth, confirming your positive thoughts are manifesting into reality.

This sequence isn’t merely about material gains; it’s a powerful endorsement of your spiritual journey. PDF interpretations emphasize that 777 validates your intuition and encourages you to trust your inner wisdom. It suggests that the universe is supporting your endeavors and opening doors to new opportunities.

Seeing 777 repeatedly is a call to embrace your spiritual gifts and share them with the world. It’s a reminder to remain optimistic, maintain a positive mindset, and continue to follow your heart. This number signifies a deepening connection to the divine and a blossoming spiritual awakening.

888: Abundance, Prosperity, and Completion

Angel number 888, thoroughly explored in numerous PDF resources dedicated to angel numbers, is a potent symbol of abundance, prosperity, and the completion of a significant cycle. Its frequent appearance signals that financial blessings and material gains are on their way, often as a direct result of your hard work and positive efforts.

However, PDF interpretations stress that 888 isn’t solely about monetary wealth. It represents a holistic abundance encompassing all areas of life – love, health, and spiritual fulfillment. This number signifies that a phase is concluding, paving the way for new beginnings and opportunities.

Seeing 888 repeatedly is a divine reassurance that you are supported and empowered to achieve your goals. It’s a call to embrace gratitude, release any limiting beliefs, and confidently step into your full potential. This number encourages you to acknowledge your accomplishments and prepare for a period of significant growth.

Using Angel Numbers for Personal Guidance

Angel number insights, often detailed in PDF guides, encourage mindful attention to accompanying thoughts and feelings, confirming your path and personal interpretations.

Paying Attention to Your Thoughts and Feelings

When encountering angel numbers – sequences often detailed in comprehensive PDF guides – the crucial step isn’t solely identifying the number itself, but deeply examining your internal state at that precise moment. What were you pondering? What emotions were present? These aren’t coincidences; they’re signposts.

The universe communicates through these patterns, and your thoughts and feelings act as the key to deciphering the message. It’s about recognizing the connection between the external symbol (the number) and your internal landscape. Many resources, including downloadable PDFs, emphasize this introspective practice.

Don’t dismiss fleeting thoughts or subtle emotions. They may be the very guidance you’ve been seeking. Consider journaling these experiences, noting the number seen and the accompanying mental and emotional climate. This practice, supported by information found in PDF resources, builds a personal understanding of your unique angelic communication style.

Angel Numbers as Confirmation of Your Path

Viewing angel numbers, thoroughly explained in numerous PDF guides, isn’t about predicting the future, but rather receiving reassurance that you’re aligned with your true purpose. They serve as gentle nudges, confirming you’re on the correct trajectory, even amidst uncertainty. Think of them as cosmic “yeses” to your intentions and aspirations.

If you’ve been contemplating a significant life change, and then repeatedly encounter a specific angel number – details readily available in PDF interpretations – consider it a powerful sign of support. It’s the universe validating your intuition and encouraging you to proceed with confidence.

These numerical confirmations aren’t directives, but rather acknowledgements of your inner wisdom. Utilize PDF resources to understand the general meaning, then apply it to your specific situation. Recognize them as positive reinforcement, bolstering your faith and empowering you to continue forward on your chosen path.

Creating a Personal “Cheat Sheet” for Reference

Given the wealth of information available – easily accessible in comprehensive PDF guides – creating a personalized angel number “cheat sheet” is incredibly beneficial. Instead of constantly searching online or flipping through lengthy PDF documents, compile the meanings that resonate most deeply with you.

Start by noting the core interpretations from reliable PDF sources, but don’t hesitate to add your own personal associations. What feelings or memories arise when you see a particular sequence? These individual connections are crucial for accurate interpretation.

Keep your cheat sheet readily available – perhaps as a bookmark in your PDF reader, a note on your phone, or a physical card in your wallet. This ensures you can quickly reference the meanings when a number appears, fostering a stronger connection to the messages and enhancing your intuitive understanding.

The Importance of Individual Interpretation

While numerous resources, including detailed PDF guides on angel numbers and meanings, offer interpretations, remember that the most significant meaning is deeply personal. Universal definitions provide a starting point, but your intuition and current life circumstances are paramount.

A PDF might state 333 signifies support from ascended masters, but how that support manifests is unique to you. Consider what you were thinking or feeling immediately before noticing the sequence. This context is key to unlocking the message’s relevance.

Don’t rigidly adhere to pre-defined meanings found in a PDF. Allow your subconscious to guide you. The numbers act as a prompt, encouraging self-reflection and a deeper understanding of your own inner wisdom. Trust your gut feeling – it’s often the most accurate interpreter.